8915 e form tax act

However be aware that if the taxpayer repays the amount you may need to amend it. March 16 2021 628 AM Form 8915-E will be completed automatically based on how the interview for Form 1099-R is completed.

How Will The Cares Act Affect My Clients 2020 Taxes Taxslayer Pro S Blog For Professional Tax Preparers

Congress enacted relief to ease the financial burden of those incurring disaster losses or have suffered financially due to the Coronavirus.

. Click the Retirement Plan Income dropdown. With those relief measures the IRS. On smaller devices click in the upper left.

It should walk you through the questionnaire. Form 8915-E will allow you to pay tax on one third of the distribution over the next three tax years. Form 8915-E is a new form is used to report coronavirus-related distributions where the taxpayer taxpayers spouse dependent or a member of the taxpayers household.

How To Pay Taxes Over 3 Years On Cares Act. Yes you can amend to file 8915-E to avoid the 10 penalty and to allow the repayment within 3 years. Only the early withdrawal 10 penalty will be.

Re When Will Form 8915-e 2020 Be Available In Tur - Page 19. Purpose of Form Use Form 8915-E if you were impacted by a qualified 2020 disaster including the coronavirus and you received a distribution described in Qualified 2020. From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal.

Solved Re Form 8915-e Is Available Today From Irs When - Page 2. From within your TaxAct return Online or Desktop click Federal. The form is on TaxAct my return has it.

Entering in Program - Form 8915-E To enter or review Form 8915-E information. You can use the steps below to make sure you have chosen the right steps to. Make sure you enter the 1099-R and check the box on that screen that it was due to a qualified disaster.

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

What You Need To Know About Coronavirus Related Distributions Before Filing Your 2020 Tax Return

Irs Issues Guidance For Coronavirus Related Distributions And Loans From Retirement Plans Under The Cares Act Maynard Cooper

How Covid Distribution From Your 401 K Factors Into 2020 Tax Return

Cares Act Distributions Tax Reporting Guidance Rules Examples Resources And More Youtube

Solved Irs Form 8915 E Intuit Accountants Community

Use Form 8915 E To Report Repay Covid Related Retirement Account Distributions Don T Mess With Taxes

2020 Irs Tax Forms Update Rightway Tax Solutions

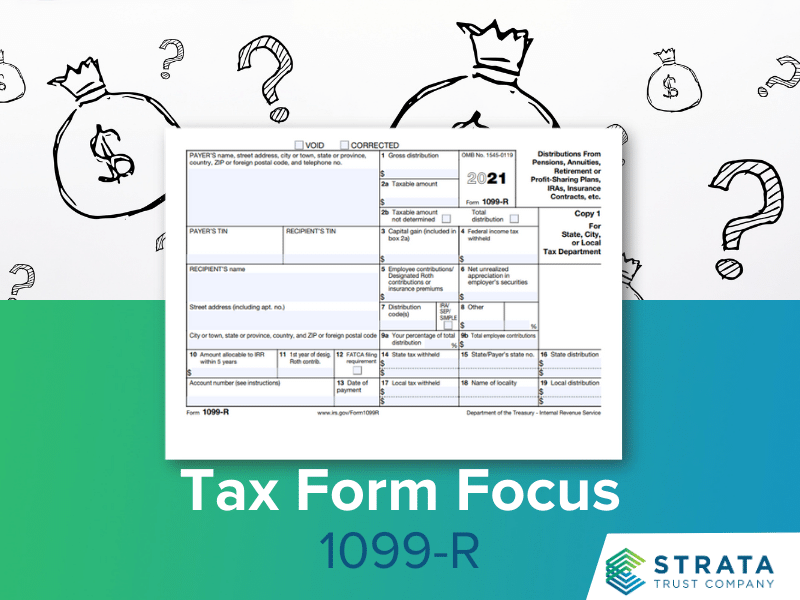

What Some Employees And Annuitants Will Not See On Their 2020 1099 R Forms

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

M O Cpe The Definitive Tax Seminar

Guidance On Cares Act Distribution And Loan Relief Expected To Resemble Hurricane Katrina Notice

Cares Act Retirement Plan Provisions With Updates As Of July 2020 Tri Ad

Taxact Video Professional Getting Started With The Software

Deep Dive Cares Act Distributions Payback Taxes Reporting My Solo 401k Financial

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service